Catastrophic Coverage

These days, it’s no secret that traditional insurance costs are sky-high. And unfortunately, those who cannot afford health insurance through the marketplace may find themselves penalized come tax time as a result. It can be a vicious cycle. At Altrua HealthShare, they believe in a faith-based approach to healthcare as an alternative to traditional insurance options. In fact, Altrua HealthShare was formed as a means of providing hard-working people with the protection they need at an affordable price, who truly subscribes to the idea behind Galatians 6:2: “Carry each other’s burdens, and in this way you will fulfill the law of Christ.”

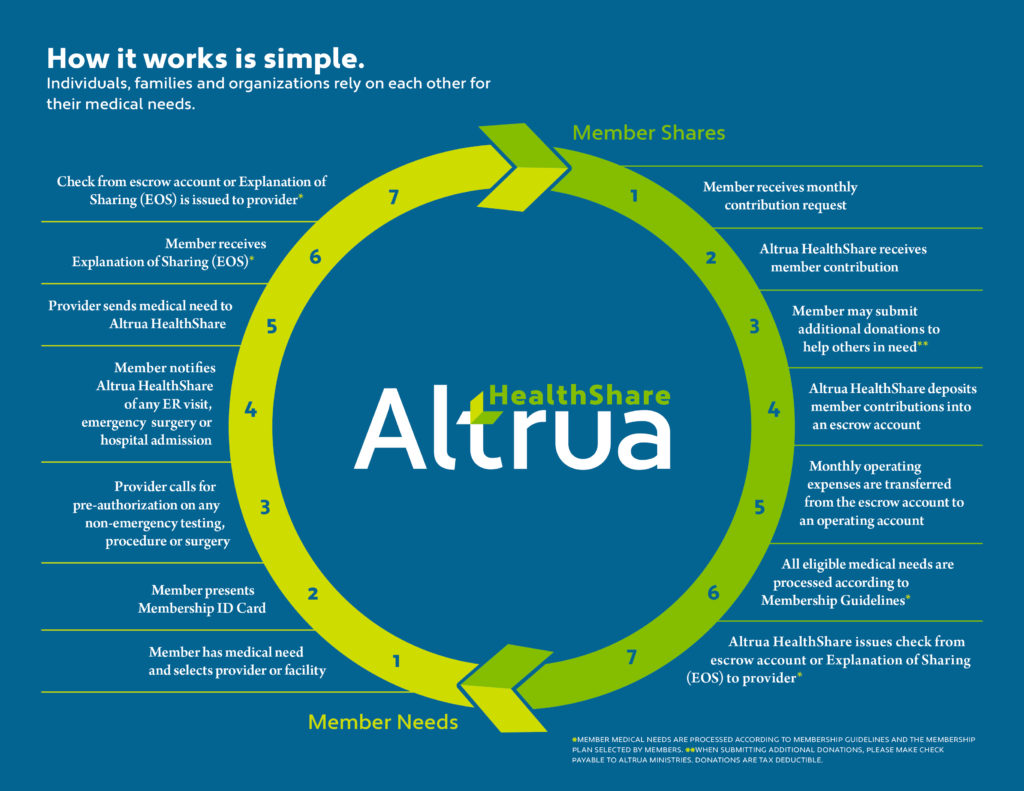

Altrua is a “nationwide faith-based health sharing organization in which members share in each other’s medical needs.” Health sharing is NOT insurance and it is NOT part of the Affordable Care Act, which means you can buy it at any time of the year. However, if you do purchase an Altrua plan, you do NOT have to pay the ACA penalty.

The Difference Between Health Sharing and Insurance

A health sharing program is an alternative to insurance that works in much the same way. However, for many people, it is the superior choice. What are the differences between a Health Care Sharing Ministry and traditional insurance?

Four main differences:

Becoming a Member

Whether you’re tired of paying high insurance premiums or simply want to become involved in a more faith-based approach to healthcare, we encourage you to explore Altrua HealthShare as a viable option today. All that is required is that members lead a clean, healthy lifestyle according to their personal faith and convictions, and that members do not share in one other’s unhealthy habits. Altrua HealthShare members lead a spiritual lifestyle according to their own convictions and are extremely invested in their personal health and wellness. Members consist of those who are newly married, families or individuals looking for a viable health care option, whereas others are young adults in their 20s who have recently been dropped from a parent’s insurance coverage.

Call the number at the top of this page to get started today.